Limited Equity Cooperative FAQs

What is a Limited Equity Housing cooperative?

A housing cooperative is a legal entity where residents jointly own and democratically manage a residential property. Each household has their own complete home with private kitchens and bathrooms like a condo or apartment. A Limited Equity Housing Cooperative means that part of the equity is owned by individual residents and the remainder is owned by the cooperative as a whole. This ensures that the homes remain permanently affordable to future residents.

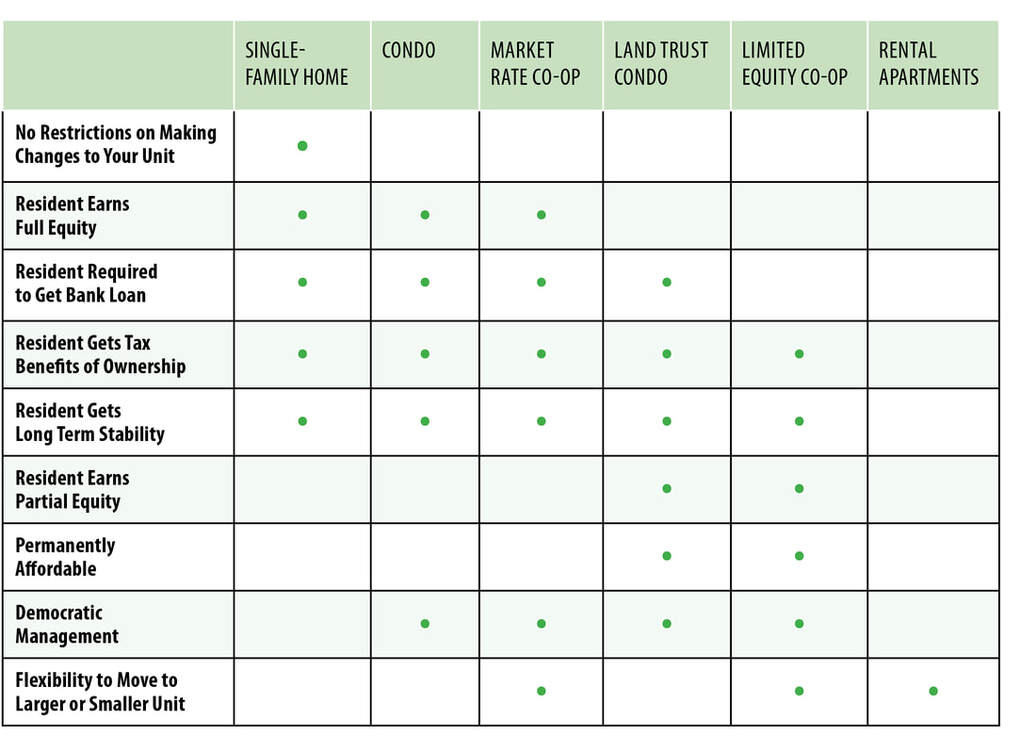

Benefits of Limited Equity Cooperative Housing include

A housing cooperative is a legal entity where residents jointly own and democratically manage a residential property. Each household has their own complete home with private kitchens and bathrooms like a condo or apartment. A Limited Equity Housing Cooperative means that part of the equity is owned by individual residents and the remainder is owned by the cooperative as a whole. This ensures that the homes remain permanently affordable to future residents.

Benefits of Limited Equity Cooperative Housing include

- Long-term housing security and stability

- Democratic decision making by the resident-owners about monthly housing cost, building investments, and policies

- Similar tax benefits as ownership

- Ability to grow community and mutual support

- Social and recreational amenities

- Affordability for future residents

- Can pass on stable costs to family members across generations

Will I have my own apartment or townhome?

Yes, each resident household has their own apartment or townhome.

Why should I buy into a cooperative instead of renting?

When you buy into a cooperative, you are a partial owner of the housing development. You get to participate democratically in the management of your housing, you have long-term stability, and your monthly expenses only pay for the actual expenses of the building—there is no outside landlord earning a profit.

Why should I buy into a cooperative instead of buying my own home?

Cooperative homeownership can be a more affordable and accessible way to own your home, especially given the high cost of homeownership in Portland. Some co-op residents choose to live in a co-op to be closer to their work and community, to put money into other investments, to live in a place where they can know their neighbors, and to support a more just economic system. Co-op owners requires much less money up-front than a traditional downpayment and households who wouldn’t qualify for a mortgage can still become owners.

Can I live in the Housing Co-op permanently?

Yes! Co-op ownership provides flexibility for people to move to units of different sizes. We are creating intergenerational living and by having a diversity of housing sizes and we hope that people will stay in the co-op as their family changes.

Will I have to attend lots of meetings to be a member of the co-op?

The whole membership will meet at least once a year to make major decisions and to elect board members to represent them. The Board meets regularly to make decisions and oversee the management of the co-op. The Co-op can either hire outside property management or do its own property management. Members may also join committees that support different aspects of community living, such as Maintenance, Gardens, Social Events, Policies, etc.

What are the income restrictions?

When residents first apply to become a member of the coop, they must show that their income is within certain limits. 25% of units at Lambert Woods South and Dougherty Commons will be reserved for households making 80% of Area Median Income or less, up to 20% of the first round of sales can be for households making up to 120% of area median income, and the remainder are capped at 100% of area median income. Your household's income is based on your federally adjusted gross number on your income tax forms. The City of Portland will oversee the first round of income verification. All applicants will have to fill out for the City of Portland: an Income Verification Form which asks for income of all household members and household size, two most recent pay stubs, most recently filed federal tax return, and IRS form 4506 (which provides permission for the city to obtain the federal tax returns from the tenant/homeowner or directly from the IRS). For HUD, we also will collect a personal financial statement for each member of the household and a credit report.

What happens if someone’s income changes over time?

With coop ownership, your income is only tested when you first apply to move into your unit. There is no annual income verification. The household must pay the assigned rent for their unit, no matter the changes to their income.

What are the monthly costs?

By state law, the monthly carrying cost of all the homes must be affordable to households making 100% of the Area Median Income (AMI) for Cumberland County, which is adjusted each year and is in 2021 was about $70,000 for one person and $100,000 for a four person household. The current estimates for our projects are for residents to pay a monthly amount including utilities ranging from roughly $1,000 to $2,500. Units will be priced based on the size of the unit and whether the household is in the 80% AMI income bracket or the 100% AMI income bracket when they first move in. Income limits and rents are adjusted up by HUD in April of each year, so our projects will likely reflect 2023 numbers which could be 10% higher. The income that matters is your Federally Adjusted Gross Income.

Detailed Underwriting Guidelines and Income and Pricing Estimates

What is the share price and how much will it cost?

The share price is the payment to purchase your part of the cooperative and is paid up front before you move in. We do not know exactly what the share price will be. We have applied to grants to the City of Portland and Cumberland County, and are watching interest rates and construction costs rise and fall. We currently expect share prices to be $30,000-$50,000, but hope we can get them lower. We are also working with lending partners to help people find loans, lower their financial obligations and increase their credit scores through financial counseling. If the monthly maintenance charges work for you, we encourage you to put a deposit to save yourself a space, and then contact us to get connected to a financial partner to work on affording the share price.

Will my monthly charges change over time?

Monthly charges will adjust each year according to the co-op's operating needs, including debt service, taxes, and inflation. The resident-owners and the Board make decisions together about any increases to monthly payments based on the actual expenses of the co-op. The co-op is required by Maine state law to keep monthly payments to a level that are affordable to households making 100% of the Area Median Income.

What happens if someone defaults on their rent?

The Co-op will have its own accountability process for people who are unable to pay rent as guided by its by-laws and leases, which could include payment plans, rent forgiveness, or terminating a person's membership and pursuing eviction.

What happens if there is an expensive unintended expense?

The Co-op budgets for unintended expenses through an annual operating contingency and capital and operating reserves. If the budget cannot support such an expense, the coop will either need to borrow money for it or charge a special assessment to members.

Can someone borrow against the equity they own?

The members' equity is equal to the amount originally invested as a share price plus up to 6% per year, the maximum allowed by State law. State statute provides that a member's share is real interest that banks may lend against, similar to other forms of collateral for debt. The Co-op specifies in its bylaws what to do if a member defaults on a loan and a bank obtains a member's share.

What is a TIF? Will our monthly payment go up when the TIF ends?

Maine allows municipalities to create Affordable Housing Tax Increment Financing (AHTIF) districts to encourage the development of affordable housing. The AHTIF allows 75% of the new tax revenue to stay with the Co-op to help keep it affordable to households of diverse incomes and protects the City from having to share the non-collected tax revenue with other municipalities. Part of the primary mortgage for the Co-op is timed to end when the AHTIF ends so that there will be no significant change in monthly costs.

Isn’t earning leveraged equity in real estate essential to building middle class wealth?

The system that boosted homeownership after WWII created wealth for property owners but higher rents and fewer affordable purchase opportunities for everyone else. Limited Equity Co-operatives provide a lower equity in housing investments in exchange for permanently affordable mixed income housing. Co-op residents do earn equity through their share price in addition to experiencing the other benefits of owning real estate, such as housing stability, decision making power, and improving their credit and financial stability. Also, many Co-op residents would never own their own home, or would have to buy in a location far from their work and community. In housing co-ops, community is something that members treasure, not just because it feels good, but because it is proven to help us succeed in our jobs, insure our kids achieve in school. It protects our health, keeps us safe, keeps our housing costs low, increases our disposable income, enriches our neighborhoods, nourishes our souls and allows us to live out our years in dignity. We consider this a form of wealth you can enjoy while living here and pass on to your children or the next generation.

I work from home so I'm wondering about the "quiet" aspect of the units. Since more folks have the option of working remotely, will sound reduction be a factor in building materials? Our current plan is to have double studded insulated walls between units, less likely between rooms within the same unit.

We are a bi-racial family and it's important to us to be living in a multiracial community. Are there plans for outreach to organizations that represent diverse populations in the Portland area? Yes, outreach to organizations that represent diverse, BIPOC and disadvantaged populations is a goal, and we are happy to have have conversations or connections with any group that can help us get the word out.

What's the best way to start connecting with other potential residents and with the local neighborhood associations?

There's also a facebook pages for both Libbytown and North Deering Neighborhood Associations. We're also hoping to gather groups of residents once we have taken a number of reservations.

What if all I want is to rent a unit?

We are hoping that all homes will be occupied by owner members.

How green are the homes? Will they be expensive to heat?

Our homes will be very comfortable, resilient, and affordable to heat and cool. We will use electric heat pumps for heating and cooling, and HRV (Heat Recovery Ventilation Systems) to ensure fresh air without drafts or loss of heat. Heating and cooling will be part of the monthly carrying charges paid to the coop.

Buildings will achieve DOE Zero Energy Ready Homes Certification, and exceed the LEED for Homes baseline (HERS 70) by 30%.

https://www.energy.gov/eere/buildings/zero-energy-ready-home-program

Is there a priority that will be given to choosing residents?

The 80% AMI "Workforce" units will give preference based on city rules, to the extent permitted under law to Eligible Households, in the following order. We have not yet determined an order for households occupying 100% units.

Can I pass on my unit to a family member or friend?

Yes, but whenever a unit changes ownership, the new owner needs to income qualify. The intent of Inclusionary Zoning is to create and preserve access to decent and affordable housing and home ownership opportunities for low-income people. Allowing an over-income family member to purchase a low-income unit takes that opportunity for home ownership away from a qualified household.

Yes, each resident household has their own apartment or townhome.

Why should I buy into a cooperative instead of renting?

When you buy into a cooperative, you are a partial owner of the housing development. You get to participate democratically in the management of your housing, you have long-term stability, and your monthly expenses only pay for the actual expenses of the building—there is no outside landlord earning a profit.

Why should I buy into a cooperative instead of buying my own home?

Cooperative homeownership can be a more affordable and accessible way to own your home, especially given the high cost of homeownership in Portland. Some co-op residents choose to live in a co-op to be closer to their work and community, to put money into other investments, to live in a place where they can know their neighbors, and to support a more just economic system. Co-op owners requires much less money up-front than a traditional downpayment and households who wouldn’t qualify for a mortgage can still become owners.

Can I live in the Housing Co-op permanently?

Yes! Co-op ownership provides flexibility for people to move to units of different sizes. We are creating intergenerational living and by having a diversity of housing sizes and we hope that people will stay in the co-op as their family changes.

Will I have to attend lots of meetings to be a member of the co-op?

The whole membership will meet at least once a year to make major decisions and to elect board members to represent them. The Board meets regularly to make decisions and oversee the management of the co-op. The Co-op can either hire outside property management or do its own property management. Members may also join committees that support different aspects of community living, such as Maintenance, Gardens, Social Events, Policies, etc.

What are the income restrictions?

When residents first apply to become a member of the coop, they must show that their income is within certain limits. 25% of units at Lambert Woods South and Dougherty Commons will be reserved for households making 80% of Area Median Income or less, up to 20% of the first round of sales can be for households making up to 120% of area median income, and the remainder are capped at 100% of area median income. Your household's income is based on your federally adjusted gross number on your income tax forms. The City of Portland will oversee the first round of income verification. All applicants will have to fill out for the City of Portland: an Income Verification Form which asks for income of all household members and household size, two most recent pay stubs, most recently filed federal tax return, and IRS form 4506 (which provides permission for the city to obtain the federal tax returns from the tenant/homeowner or directly from the IRS). For HUD, we also will collect a personal financial statement for each member of the household and a credit report.

What happens if someone’s income changes over time?

With coop ownership, your income is only tested when you first apply to move into your unit. There is no annual income verification. The household must pay the assigned rent for their unit, no matter the changes to their income.

What are the monthly costs?

By state law, the monthly carrying cost of all the homes must be affordable to households making 100% of the Area Median Income (AMI) for Cumberland County, which is adjusted each year and is in 2021 was about $70,000 for one person and $100,000 for a four person household. The current estimates for our projects are for residents to pay a monthly amount including utilities ranging from roughly $1,000 to $2,500. Units will be priced based on the size of the unit and whether the household is in the 80% AMI income bracket or the 100% AMI income bracket when they first move in. Income limits and rents are adjusted up by HUD in April of each year, so our projects will likely reflect 2023 numbers which could be 10% higher. The income that matters is your Federally Adjusted Gross Income.

Detailed Underwriting Guidelines and Income and Pricing Estimates

What is the share price and how much will it cost?

The share price is the payment to purchase your part of the cooperative and is paid up front before you move in. We do not know exactly what the share price will be. We have applied to grants to the City of Portland and Cumberland County, and are watching interest rates and construction costs rise and fall. We currently expect share prices to be $30,000-$50,000, but hope we can get them lower. We are also working with lending partners to help people find loans, lower their financial obligations and increase their credit scores through financial counseling. If the monthly maintenance charges work for you, we encourage you to put a deposit to save yourself a space, and then contact us to get connected to a financial partner to work on affording the share price.

Will my monthly charges change over time?

Monthly charges will adjust each year according to the co-op's operating needs, including debt service, taxes, and inflation. The resident-owners and the Board make decisions together about any increases to monthly payments based on the actual expenses of the co-op. The co-op is required by Maine state law to keep monthly payments to a level that are affordable to households making 100% of the Area Median Income.

What happens if someone defaults on their rent?

The Co-op will have its own accountability process for people who are unable to pay rent as guided by its by-laws and leases, which could include payment plans, rent forgiveness, or terminating a person's membership and pursuing eviction.

What happens if there is an expensive unintended expense?

The Co-op budgets for unintended expenses through an annual operating contingency and capital and operating reserves. If the budget cannot support such an expense, the coop will either need to borrow money for it or charge a special assessment to members.

Can someone borrow against the equity they own?

The members' equity is equal to the amount originally invested as a share price plus up to 6% per year, the maximum allowed by State law. State statute provides that a member's share is real interest that banks may lend against, similar to other forms of collateral for debt. The Co-op specifies in its bylaws what to do if a member defaults on a loan and a bank obtains a member's share.

What is a TIF? Will our monthly payment go up when the TIF ends?

Maine allows municipalities to create Affordable Housing Tax Increment Financing (AHTIF) districts to encourage the development of affordable housing. The AHTIF allows 75% of the new tax revenue to stay with the Co-op to help keep it affordable to households of diverse incomes and protects the City from having to share the non-collected tax revenue with other municipalities. Part of the primary mortgage for the Co-op is timed to end when the AHTIF ends so that there will be no significant change in monthly costs.

Isn’t earning leveraged equity in real estate essential to building middle class wealth?

The system that boosted homeownership after WWII created wealth for property owners but higher rents and fewer affordable purchase opportunities for everyone else. Limited Equity Co-operatives provide a lower equity in housing investments in exchange for permanently affordable mixed income housing. Co-op residents do earn equity through their share price in addition to experiencing the other benefits of owning real estate, such as housing stability, decision making power, and improving their credit and financial stability. Also, many Co-op residents would never own their own home, or would have to buy in a location far from their work and community. In housing co-ops, community is something that members treasure, not just because it feels good, but because it is proven to help us succeed in our jobs, insure our kids achieve in school. It protects our health, keeps us safe, keeps our housing costs low, increases our disposable income, enriches our neighborhoods, nourishes our souls and allows us to live out our years in dignity. We consider this a form of wealth you can enjoy while living here and pass on to your children or the next generation.

I work from home so I'm wondering about the "quiet" aspect of the units. Since more folks have the option of working remotely, will sound reduction be a factor in building materials? Our current plan is to have double studded insulated walls between units, less likely between rooms within the same unit.

We are a bi-racial family and it's important to us to be living in a multiracial community. Are there plans for outreach to organizations that represent diverse populations in the Portland area? Yes, outreach to organizations that represent diverse, BIPOC and disadvantaged populations is a goal, and we are happy to have have conversations or connections with any group that can help us get the word out.

What's the best way to start connecting with other potential residents and with the local neighborhood associations?

There's also a facebook pages for both Libbytown and North Deering Neighborhood Associations. We're also hoping to gather groups of residents once we have taken a number of reservations.

What if all I want is to rent a unit?

We are hoping that all homes will be occupied by owner members.

How green are the homes? Will they be expensive to heat?

Our homes will be very comfortable, resilient, and affordable to heat and cool. We will use electric heat pumps for heating and cooling, and HRV (Heat Recovery Ventilation Systems) to ensure fresh air without drafts or loss of heat. Heating and cooling will be part of the monthly carrying charges paid to the coop.

Buildings will achieve DOE Zero Energy Ready Homes Certification, and exceed the LEED for Homes baseline (HERS 70) by 30%.

https://www.energy.gov/eere/buildings/zero-energy-ready-home-program

Is there a priority that will be given to choosing residents?

The 80% AMI "Workforce" units will give preference based on city rules, to the extent permitted under law to Eligible Households, in the following order. We have not yet determined an order for households occupying 100% units.

- First time homebuyer, 2. Current residents of the City who have lived in Portland as their primary residence for the past two year, 3 Previous residents of the City who were displaced within the last 12 months prior to the Workforce Unit becoming available. 4. Persons employed full time by the City. 5. All others

Can I pass on my unit to a family member or friend?

Yes, but whenever a unit changes ownership, the new owner needs to income qualify. The intent of Inclusionary Zoning is to create and preserve access to decent and affordable housing and home ownership opportunities for low-income people. Allowing an over-income family member to purchase a low-income unit takes that opportunity for home ownership away from a qualified household.